Employer’s pension insurance i.e. TyEL

Employer’s pension insurance, i.e. TyEL insurance, is a statutory insurance that secures the pension of your employee. On this page you can find information about TyEL insurance.

What is TyEL insurance?

TyEL insurance is pension insurance in compliance with the Employees Pensions Act (TyEL). TyEL insurance is the employee’s pension cover and therefore it is a statutory i.e. a mandatory insurance. With TyEL insurance you ensure that your employees receive the pension they earned, as every salary you pay accrues pension for your employee.

In addition to pension cover, the employer’s pension insurance secures your employee’s income in the event of disability and the death of a family provider, and enables vocational rehabilitation.

When do I need to take out TyEL insurance?

Insure your employee with the TyEL insurance, when they meet these conditions:

- they are in an employment relationship,

- they are at least 17 years old and

- you pay them at least EUR 71.72 per month in 2026 (EUR 70.08 per month in 2025).

Take out TyEL insurance at the latest the day before you report the earnings data to the Incomes Register. These terms also apply to household employers, i.e. persons who hire, for example, a renovator or a nanny to work at their home.

Age limits for TyEL insurances

The lower age limit for TyEL insurance begins at the start of the month following the month in which the employee turns 17. The obligation to insure ends at the end of the month in which the upper age limit has been reached.

The upper age limit for TyEL insurance depends on which year the employee was born:

- in or before 1957, the limit is 68 years

- 69 years for those born between 1958 and 1961

- in or before 1962, the limit is 70 years.

How much does TyEL insurance cost?

The TyEL contribution is determined based on the earnings payment reports made to the Incomes Register. The TyEL contribution is a percentage of the salaries and wages that you pay to your employees as an employer. The client bonus reduces your insurance contribution. The total amount distributed as customer refunds is based on Ilmarinen's solvency.

As an employer you do not pay the entire TyEL contribution; your employees pay a portion of it themselves. As an employer, you deduct the employee's contribution from the employee’s salary and account the entire TyEL payment to us.

Why should I get TyEL insurance from Ilmarinen?

- Competitive price – we pay excellent client bonuses – for you this means smaller TyEL contributions.

- Comprehensive work ability services – you get access to services developed by top specialists, from survey tools to training.

- Responsible pension cover – our operations are responsible and we invest pension assets profitably and securely.

- A financially sound partner – your employees’ pension is secure with a solvent pension insurance company.

- Easy insurance – we are at your service online 24/7.

- Competent service – our competent professionals help you with any questions related to insurance, pensions and work ability.

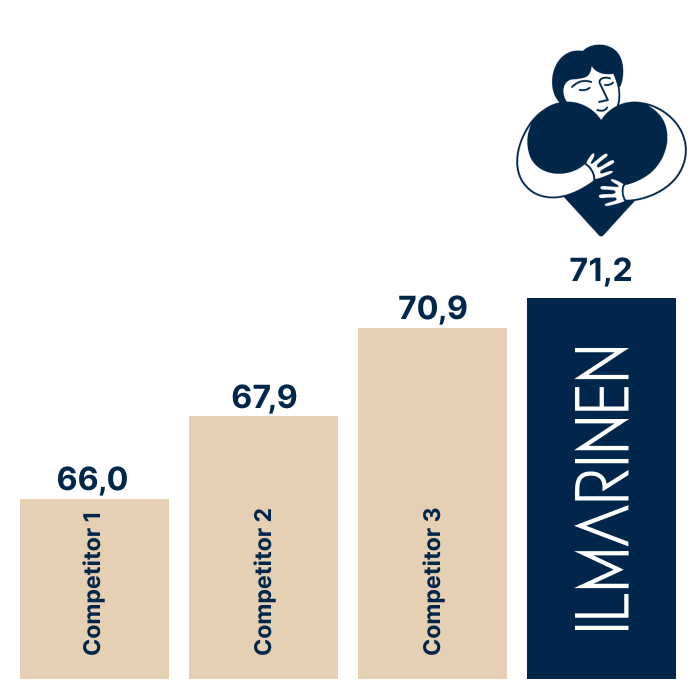

Join Finland’s most satisfied customers

Get TyEL insurance easily and quickly online.

Get insured now or find out more

-

Employer’s calculators

Use the different calculators to see for example how much TyEL insurance costs or how much hiring an employee costs.

Go to the employer’s calculators -

Insuring work abroad

Are you posting an employee to work abroad? Or is an employee coming from abroad to work in your company?

Read more about insuring work abroad -

Changes on entrepreneurial activities

When your company’s business operations or legal form change, your TyEL and YEL insurance may also change.

Read more about the impact of changes in business operations on TyEL insurance -

Retirement of an employee

What does an employer need to know when an employee wishes to retire? Learn about the different types of pension.

Read more about the retirement of an employee -

TyEL certificate and invoice copies

You can download the TyEL certificate and invoice copies conveniently in our online service.

Read more about the TyEL certificate and invoice copies -

Terms and conditions for TyEL insurance

Learn more about the terms and conditions for Ilmarinen’s insurance policies in compliance with the Employees Pensions Act (TyEL).

Read about the terms and conditions for TyEL insurance