Employer, you can see the client bonuses online

We have calculated the final client bonuses reducing the TyEL contribution and they are available in the online service as of March 5th. Our further improved cost-effectiveness is directly reflected in smaller pension contributions for our employer customers.

As a rule, the discounts in contributions will be taken into account in future TyEL invoices starting in March. If you have overdue unpaid invoices, the client bonuses will first be allocated to these.

In our online service, under Account statement, you can see the amount of the refund and how the refunds have been targeted. You will be able to see this online from March 9th.

At the same time, you can let us know your bank account number for any insurance contribution refunds.

The customer credits returned this year will be calculated according to the new model. The client bonuses are based solely on the solvency of the earnings-related pension company. Ilmarinen's strong solvency is a result of long-term investment activities and good investment returns.

Read more about the client bonus

We use the Suomi.fi e-Identification service in our online service.

Read more about the Suomi.fi e-Authorizations

Pricing of expense loading changed at the start of 2023

As of the start of 2023, the expense loading in earnings-related pension contributions is determined for each company. Expense loading is the part of the pension contribution that is used to cover the pension company’s operations; in other words, the costs arising from managing insurance policies and pensions.

Ilmarinen’s cost-effectiveness improved further in 2023, as premiums written grew 4 per cent and operating expenses financed using loading income fell 5 per cent. Our customers benefit directly from the improvement in our efficiency: we lowered the administrative cost component included in Ilmarinen’s earnings-related pension insurance contribution by 20 per cent as of the start of 2024.

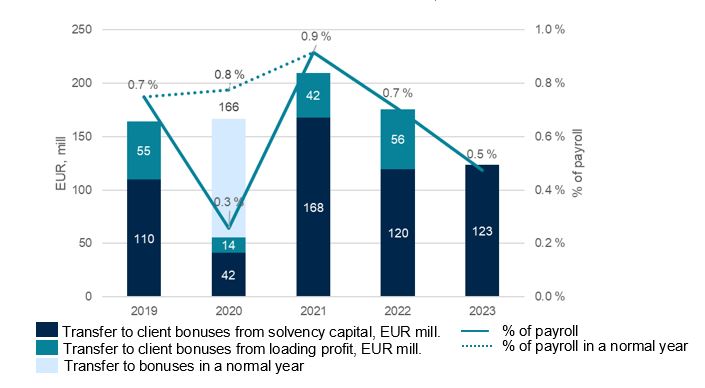

Based on the excellent loading profit and solvency, Ilmarinen will refund EUR 123.5 million in client bonuses to its customers this year.

The expense loading is now company-specific and always up-to-date. Each pension company only charges the necessary amount of the expense loading, and there is no systematic surplus. This means that there will be no surprises in store and no more need for annual adjustments.

Ilmarinen’s administrative cost will decrease 20% in 2024

Client bonuses EUR million and in relation to payroll

In 2020, employment pension insurance companies refrained from paying client bonuses to customer companies for the period in which the employers’ contribution was reduced. Therefore, the client bonus for 2020 was only a third of a normal year’s client bonus.

Read more

Current topics

Earnings-related pension insurance contributions for 2025 confirmed

The Ministry for Social Affairs and Health has confirmed the earnings-related pension insurance contributions for 2025. The average contribution for employer’s pension insurance (TyEL) is 24.85 per cent of the payroll in 2025.

Employer, self-employed person, pensioner – 2025 earnings-related pension index and wage coefficient confirmed

The Ministry for Social Affairs and Health has confirmed the indices for earnings-related pension insurance for 2025. Next year, the earnings-related pension index is 3077, which means an approximately 1.3 per cent increase on pensions at the start of the year. The confirmed wage coefficient is 1.673. Compared to 2024, the wage coefficient will rise some 2.2 per cent.

Ilmarinen's return on investment rose to 7.4 per cent, solvency strengthened and cost efficiency improved

Ilmarinen's return on investment in the period January–September was 7.4 per cent, or EUR 4.4 billion. Investment assets rose to EUR 62.9 billion and solvency capital to EUR 14 billion. Cost effectiveness continued to improve and is reflected in lower premiums for customers.