Excellent client bonuses in store for employers – check the amount in the service for employers

We have calculated the final client bonuses reducing the TyEL contribution and they are available in the service for employers as of 3 March. Our record-high cost-effectiveness is directly reflected in smaller pension contributions for our employer customers.

As a rule, the discounts in contributions will be taken into account in future TyEL invoices starting in March. If you have overdue unpaid invoices, the client bonuses will first be allocated to these.

As of March, you can also check online where the client bonuses have been allocated. To see the allocations and amount of client bonus, open the statement in the service for employers.

At the same time, you can let us know your bank account number for any insurance contribution refunds.

Pricing of expense loading changed at the start of the year

The client bonuses being paid now are still based on the old model as they apply to insurance contributions for 2022. The client bonuses you will receive now are thus based on the efficiency of our operations and solvency last year.

As of the start of 2023, the expense loading in earnings-related pension contributions is determined for each company. Expense loading is the part of the pension contribution that is used to cover the pension company’s operations; in other words, the costs arising from managing insurance policies and pensions. Ilmarinen’s record-high cost-effectiveness means that the pension contributions of our employer customers are less expensive with regard to the expense loading. The change means that the discount for large employers will end and it will be included directly in the expense loading.

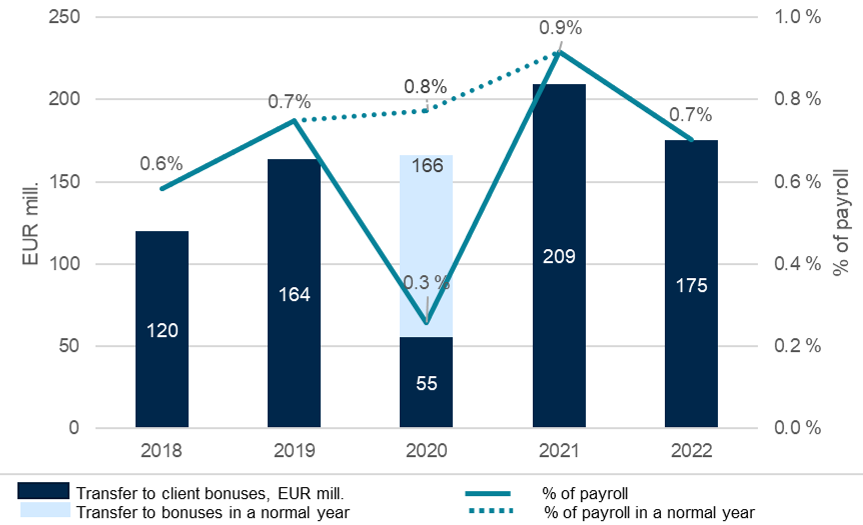

Based on the excellent loading profit and solvency, Ilmarinen will refund EUR 175 million in client bonuses to its customers this year.

The expense loading is now company-specific and always up-to-date. This means that there will be no surprises in store and no more need for annual adjustments.

The change means that the earnings-related pension contribution’s administrative cost component will be reduced and the loading profit will fall.

Client bonuses EUR million and in relation to payroll

In 2020, employment pension insurance companies refrained from paying client bonuses to customer companies for the period in which the employers’ contribution was reduced. Therefore, the client bonus for 2020 was only a third of a normal year’s client bonus.

Changes to client bonuses in 2024

The client bonuses to be refunded to customers next year will be calculated according to the new model. Going forward, client bonuses will be based solely on the pension insurance company’s solvency. Ilmarinen’s strong solvency is the result of long-term investment operations and good investment returns.

Read more

Read more about client bonuses

Current topics

Earnings-related pension insurance contributions for 2025 confirmed

The Ministry for Social Affairs and Health has confirmed the earnings-related pension insurance contributions for 2025. The average contribution for employer’s pension insurance (TyEL) is 24.85 per cent of the payroll in 2025.

Employer, self-employed person, pensioner – 2025 earnings-related pension index and wage coefficient confirmed

The Ministry for Social Affairs and Health has confirmed the indices for earnings-related pension insurance for 2025. Next year, the earnings-related pension index is 3077, which means an approximately 1.3 per cent increase on pensions at the start of the year. The confirmed wage coefficient is 1.673. Compared to 2024, the wage coefficient will rise some 2.2 per cent.

Ilmarinen's return on investment rose to 7.4 per cent, solvency strengthened and cost efficiency improved

Ilmarinen's return on investment in the period January–September was 7.4 per cent, or EUR 4.4 billion. Investment assets rose to EUR 62.9 billion and solvency capital to EUR 14 billion. Cost effectiveness continued to improve and is reflected in lower premiums for customers.