We invest in a sustainable future – the Ilmarinen Climate Roadmap defines our path to net zero carbon pension assets

Climate change poses a risk also to future pensions in Finland. Ilmarinen manages the risks brought about by climate change by seeking to achieve carbon neutrality in the investment of pension assets by the end of 2035. The new Climate Roadmap describes the interim targets, actions and tools to reach the net zero carbon goal.

“Climate change related risks are changing the risk-return profile of both individual companies and entire industries. This change is taking place in all markets, which leads to increasing risks but also to new opportunities in Ilmarinen’s portfolio. We must take this into account when investing pension assets in order to also secure future pensions,” says Ilmarinen’s Deputy CEO, Investments Mikko Mursula.

“In the big picture, the degree to which we succeed in mitigating climate change also has an impact on the economy and the investment markets. This entails changes in the whole pension system’s operating environment,” Mursula adds.

The new Ilmarinen Climate Roadmap describes how Ilmarinen will achieve its net zero carbon goal in the investment of pension assets by the end of 2035. The goal is part of considering the ESG risks and effectiveness of investments. By integrating ESG risks into its investment decisions, Ilmarinen promotes the productive and secure investing of pension assets.

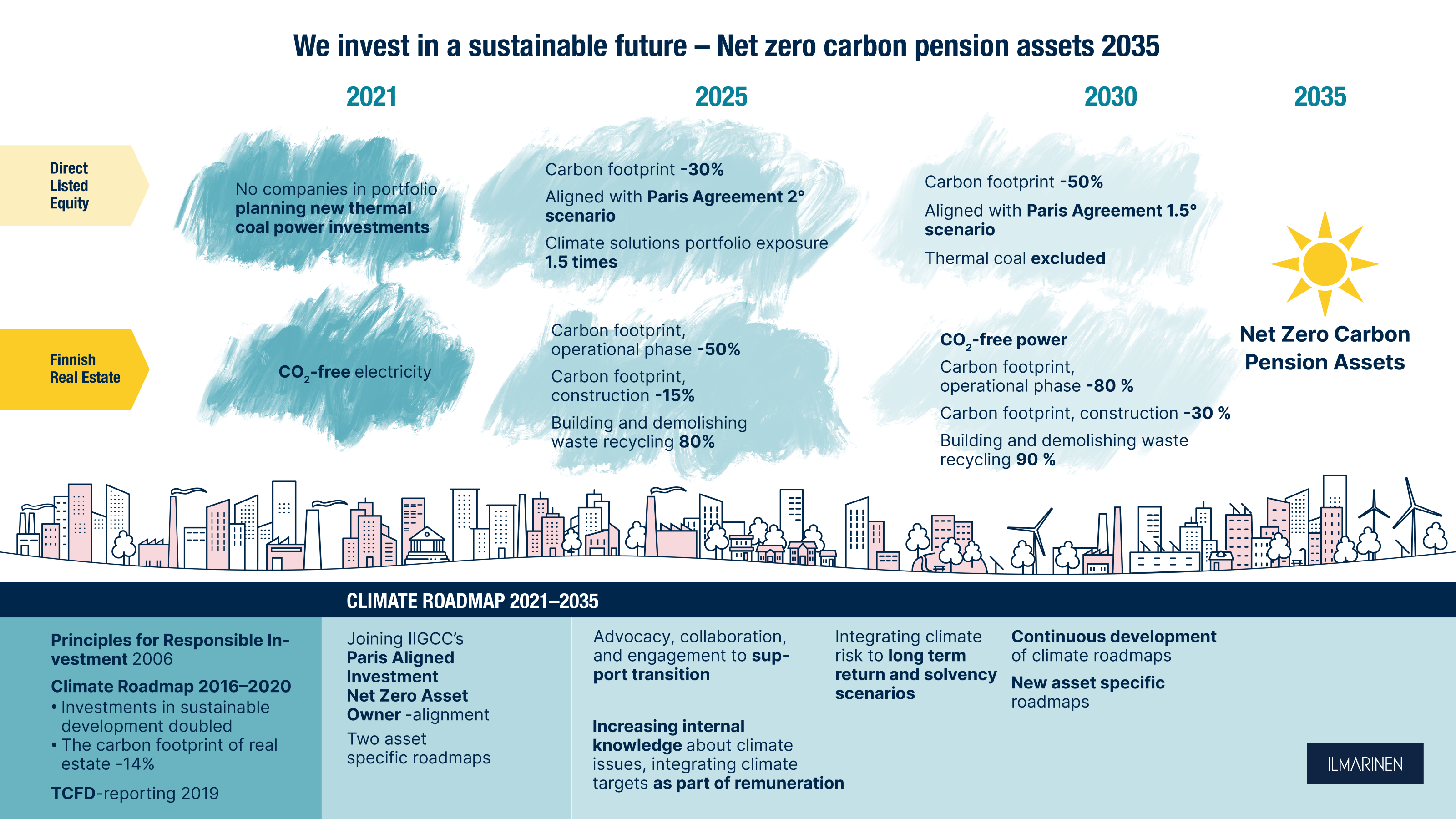

The Roadmap is divided into general actions concerning the entire portfolio and into two asset-class-specific roadmaps that cover direct listed equities and Finnish real estate.

“Both are significant asset classes also from the perspective of our climate impacts. We are a major property developer in Finland. Globally, the built environment is responsible for around 40 percent of all greenhouse gas emissions,” says Karoliina Lindroos, Head of Responsible Investment.

“In addition, a wealth of data and analytics is already available for both asset classes, enabling us to set interim targets and measure our progress. Climate data, analytics and the best practices of the industry evolve rapidly. That is why it is paramount for our roadmap to be a living document that allows us to learn more and continuously develop our climate actions as we implement the roadmap. In the upcoming years, we will develop the roadmaps further, adding more asset classes,” Lindroos says.

The Roadmap describes, among other things, the gradually tightening criteria used by Ilmarinen to screen and reduce investments that include carbon risk. As real emission reductions cannot be reached through negative screening alone, Ilmarinen also invests in companies in transition that are decarbonizing their operations and promotes decarbonization through stewardship and engagement. Collaboration with other investors also plays a key role.

“The more we investors set aligned targets, the greater the impact on investees. We have joined a number of international commitments and investor initiatives that promote companies’ transition to a low-carbon economy. In practice, the transition means that companies achieve significant cuts in real emissions,” Lindroos explains.

At the end of September, the value of pension assets invested by Ilmarinen was EUR 58.4 billion. The assets are diversified across several industries and assets classes worldwide.

“The fact is that we cannot achieve carbon neutrality alone. We use all of the means available to us: we decarbonise our investment portfolio, increase investments in climate solutions, guide our investees towards a low-carbon economy and promote climate action together with other investors and our stakeholders. Our expectations for the Glasgow Climate Change Conference are high, as a rapid market transition at scale requires strong government action in terms of regulation and carbon pricing. In addition, further measures are required to foster the transition to a low-carbon economy, such as supporting private sector innovation and creating an enabling environment for consumer demand for climate solutions,” says Mursula.

Download Ilmarinen Climate Roadmap (pdf) Version 2022

Download Ilmarinen Climate Roadmap (pdf), latest version (2023), in Finnish

Key interim targets in the Ilmarinen Climate Roadmap

- No investments in companies that are planning new coal investments (2021)

- Carbon footprint of listed equities -30% in 2020–2025 and -50% in 2020–2030

- Listed equity investments aligned with the Paris Agreement’s 2-degree scenario in 2025 and with the 1.5-degree scenario in 2030

- Only CO2-free electricity in real estate as of 2021

- Real estate’s in-use carbon footprint -50% in 2025 and -80% in 2030 (from the average of 2018–2020)

- Real estate’s total energy CO2-free in 2030

For more information

Current topics

A diverse workplace is a choice – and a resource

A diverse community accepts and appreciates differences. Diversity at work is also tightly connected to inclusivity and equality. At IKEA, diversity is an important part of the work community and daily work. The community is easy to join and lets everyone’s voice be heard.

Ilmarinen’s return on investments 3.2 per cent and efficiency improved further

The return on Ilmarinen’s investments in January–March was 3.2 per cent. The company’s cost-effectiveness improved further as premiums written grew and the operating expenses necessary for providing pension security fell. “We have successfully continued implementing Ilmarinen’s strategy and improved our productivity significantly over the past six years,” says Ilmarinen’s CEO Jouko Pölönen.

The carbon footprint of Ilmarinen’s investment portfolio decreased significantly

Earnings-related pension company Ilmarinen saw the carbon footprint of its investment portfolio decrease and the share of renewable energy in its investee companies increase significantly in 2023. This information comes from Ilmarinen’s Annual and Sustainability Report 2023.