Ilmarinen

/

Pension and rehabilitation

/

Pension alternatives

/

Survivors’ pension for surviving spouses and children

Survivors’ pension for surviving spouses and children

If your spouse passes away, the survivors’ pension helps secure an income. You are eligible for a surviving spouse’s pension and your under 20 years old children for an orphan’s pension.

When can I receive survivors’ pension?

You can receive surviving spouse’s pension as of the beginning of the month following the death of your spouse. Your children can receive orphan’s pension as of the beginning of the month following the death of their parent. The pension can be granted retroactively for no more than six months.

Do like this

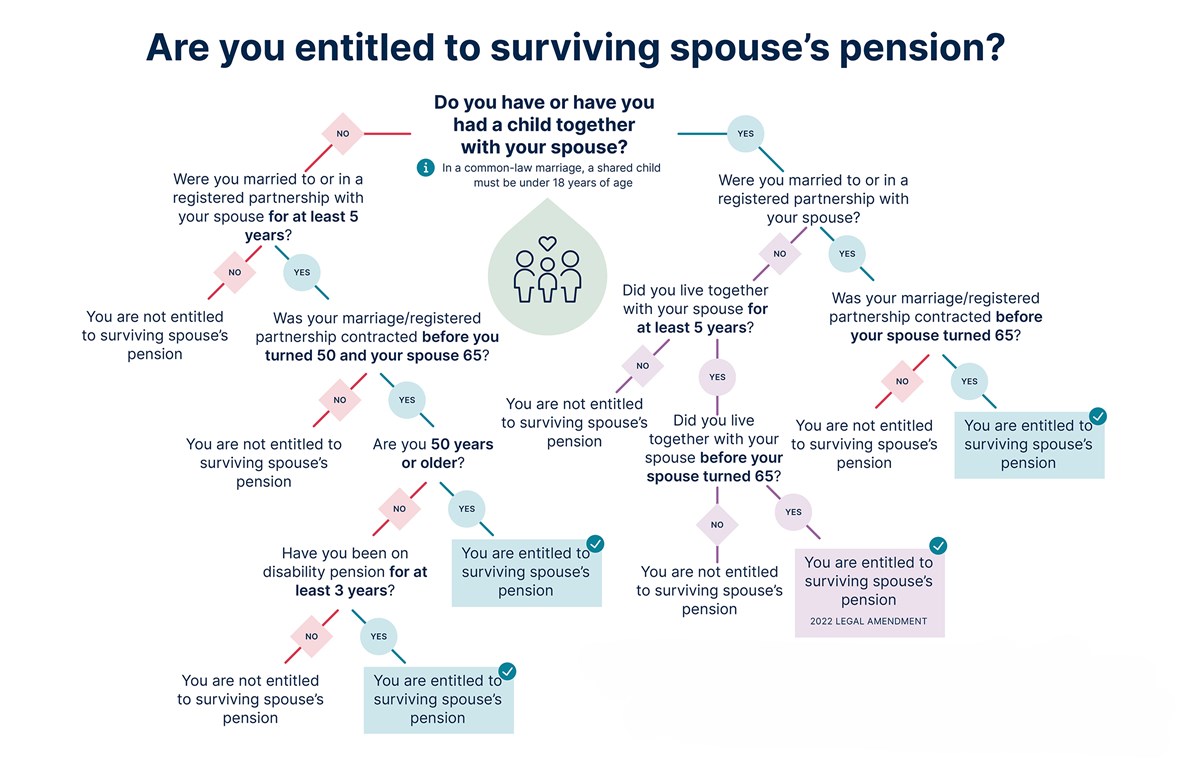

- Check from the picture below if you are entitled to surviving spouse’s pension.

- Estimate the amount of surviving spouse’s pension using the survivors’ pension calculator.

- Fill in a survivors’ pension application for a surviving spouse and a child in the MyPension service.

Are you entitled to surviving spouse's pension?

If you are widowed, you may be eligible for surviving spouse’s pension. You may receive the pension regardless of whether your spouse was an employee, self-employed or unemployed. In the picture below, you can see whether you are entitled to surviving spouse’s pension.

You may receive surviving spouse’s pension if you were married, in a registered partnership or a common-law marriage with your spouse or you received personal continuous child support from your ex-spouse.

Child together with a spouse

If you have or have had a child together and your marriage or registered partnership was contracted before your spouse turned 65, you may be entitled to surviving spouse’s pension. In a common-law marriage, you may be entitled to surviving spouse’s pension if you and your spouse have underage children together living in the same household, and you and your spouse lived together for at least five years. Before 2022, common-law spouses were not entitled to surviving spouse’s pension.

No children together

Common-law spouses are not entitled to surviving spouse’s pension if they have no underage children together.

In a marriage or registered partnership, you may receive surviving spouse’s pension even if you have no children together with your spouse. However, the following conditions must be met:

- you were at least 50 years old when your spouse died or you have received a disability pension for at least three years and

- your marriage had lasted at least five years before your spouse’s death and

- the marriage was contracted before you turned 50 and your spouse turned 65

You may also receive the pension if you married after you turned 50. This is the case if you are a widow and you were born on or before 1 July 1950 and your marriage was valid on 1 July 1990.

Fixed term period of surviving spouse’s pension

For surviving spouses born in or after 1975, surviving spouse’s pension is granted for a fixed period of ten years or at least until the youngest child turns 18. The fixed-term period does not apply to surviving spouse’s pensions granted before 2022 or to surviving spouses born before 1975.

Orphan’s pension until the age of 20

If your spouse has a child under 20, the child is entitled to survivors’ pension. Orphan’s pension may be granted regardless of whether or not the child lived with your spouse. Both biological and adopted children have the right to receive orphan’s pension, but foster children do not.

A surviving spouse’s child can also receive orphan’s pension even if the deceased spouse was not his or her parent. This is the case if the child lived with the surviving spouse and the spouse in the same household when the spouse died. However, the surviving spouse’s child may receive orphan’s pension only if the surviving spouse and spouse were married or in a registered partnership.

Amount of survivors’ pension

The survivors’ pension is based on your spouse’s earnings-related pension. The amount of survivors’ pension is affected by your earnings-related pension and the number of children. The amount of pension is not affected by your or your spouse’s national pension, voluntary pensions or assets of the estate.

Amount of surviving spouse's pension

The amount of surviving spouse’s pension is at most half of the spouse’s earnings-related pension. The number of children receiving orphan’s pension affects the amount of the surviving spouse’s pension.

If you receive your personal earnings-related pension or you are over 65 and do not have children under 18, the amount of your surviving spouse’s pension will be affected by the amount of your personal earnings-related pension. If your own earnings-related pension is large, it is possible that you will not receive survivors’ pension.

If you do not yet receive earnings-related pension, you can receive surviving spouse’s pension as an initial pension for six months. The amount of this initial pension is half of your spouse’s earnings-related pension. After the initial pension, the amount of your surviving spouse’s pension will be adjusted and possibly reduced. If one or more children receiving orphan’s pension lives in the same household, the amount of your surviving spouse’s pension will be adjusted only when the youngest child turns 18. The amount of your surviving spouse’s pension will also be adjusted when you start collecting your own earnings-related pension. If the amount of your surviving spouse’s pension changes, request a new tax card from the tax authority on the website vero.fi.

-

Survivors' pension calculator

Use our calculator to estimate how much your surviving spouse's pension would be.

Go to calculator

| Part of calculation | Amount |

| Deceased’s basic pension amount | EUR 1,100 |

| Surviving spouse’s basic pension | EUR 550 = half of the deceased’s basic pension |

| Surviving spouse’s reduction | EUR 74.75 € = how the figure is formed is explained below in the section ‘Calculating the reduction in surviving spouse’s pension’ |

| Surviving spouse’s basic pension to be paid | EUR 475.25 (= EUR 550 – EUR 74.75) |

Calculating the reduction in surviving spouse’s pension

| Part of calculation | Amount |

| Surviving spouse’s earnings-related pension | EUR 900 |

| Basis for reducing the surviving spouse’s pension | EUR 750.50 = limit confirmed by the Ministry of Social Affairs and Health annually |

| Excess, i.e. the difference between the surviving spouse’s own earnings-related pension and the basis for reducing the surviving spouse’s pension |

EUR 149.50 (= EUR 900.00 – EUR 750.50) |

| Reduction in surviving spouse’s pension i.e. half of the excess |

EUR 74.75 (= EUR 149.50 / 2) |

Amount of orphan's pension

The amount of orphan’s pension depends on how many children are being paid orphan’s pension. If there is no recipient of surviving spouse’s pension in the family, the surviving spouse’s share of the survivor’s pension is granted to the children.

An underage child’s pension can be paid to the bank account of the child’s guardian or to the child’s own bank account. When the child reaches the age of 18, the orphan’s pension is paid to the child’s own bank account. If the amount of the orphan’s pension changes or if the payment of it continues until the child turns 20, check to see whether you need to change the tax percentage on the tax authority’s website at vero.fi.

The table illustrates how the number of children affects the survivors’ pension. The pension is divided into 12 parts, whereby the fraction 12/12 is the full survivors’ pension and 6/12 is half of the pension.

| Pension | No children | 1 child | 2 children | 3 children | 4 or more children |

|---|---|---|---|---|---|

| Surviving spouse's pension | 6/12 | 6/12 | 5/12 | 3/12 | 2/12 |

| Total orphan's pensions | - | 4/12 | 7/12 | 9/12 | 10/12 |

| Total survivors' pension | 6/12 | 10/12 | 12/12 | 12/12 | 12/12 |

| Definition | Amount |

| Deceased’s basic pension amount | EUR 2,000 |

| Surviving spouse’s share | 5/12 * EUR 2,000 = EUR 833.33 |

| Total orphan’s pensions | 7/12 * EUR 2,000 = EUR 1,166.67 |

| Each child’s share without the surviving spouse’s share | EUR 1,166.67 / 2 = EUR 583.34 |

| The surviving spouse’s share is distributed equally among both children | EUR 833.33 / 2 = EUR 416.66 |

| Each child’s share of the orphan’s pension | EUR 583.34 + EUR 416.66 = EUR 1,000 |

If your spouse died in an occupational accident or traffic accident, you can also receive compensation from his or her employer’s or company’s accident insurance company or the motor liability insurance company of the person who caused the accident. The compensation can reduce the survivors’ pension paid by Ilmarinen.

You can also receive compensation from the employees’ group life insurance. Apply for it to the Employees’ group life insurance pool (tvk.fi).

You can also receive survivor pension from Kela. Read more (kela.fi).

If the deceased had worked abroad, you and your children may also receive survivors’ pension from his or her countries of employment.

-

Payment and taxation of pensions

Pension is paid on the first banking day of each month. Pension is taxable income. You need to order a tax card for pension from the tax authority. Order a pension tax card from the tax authority Vero.fi.

Read more about the payment and taxation of pensions -

Working while on a pension

You can work while drawing a survivors’ pension.

ead more about working while on a pension -

MyPension service

In the MyPension service, you can apply for pension, change your account number and print out a pension certificate or send messages.

Take a look at the MyPension service